In the dynamic and rapidly evolving world of FinTech, data security and privacy have become critical concerns. Financial institutions manage vast amounts of sensitive information, including personal identification data, transaction histories, and behavioral insights.

The imperative to safeguard such data against breaches, unauthorized access and misuse has led to the adoption of advanced privacy-preserving technologies.

Among these, Differential Privacy (DP) stands out as a transformative approach that balances data utility with privacy preservation. This blog post explores the significance of DP in the FinTech domain, its operational principles and its practical applications.

Differential Privacy

Differential Privacy is a mathematical framework designed to provide robust privacy guarantees when analyzing and sharing data. By introducing carefully calibrated noise into data outputs or queries, DP ensures that no single individual’s information can be discerned, even if an attacker has access to auxiliary information.

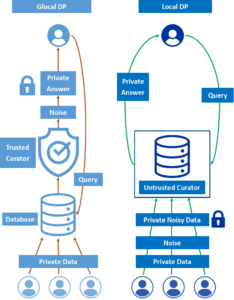

- Central Differential Privacy (CDP): In this model, raw data is transmitted to a trusted server, which applies noise before responding to queries. CDP is widely utilized in machine learning, deep learning and statistical analyses.

- Local Differential Privacy (LDP): Here, noise is added directly by the data owner before sharing. This model is ideal when trust in centralized servers is limited, though it typically results in reduced data utility compared to CDP.

The FinTech sector, characterized by its reliance on data-driven insights, can leverage DP in numerous ways:

- Customer Data Analysis: Financial institutions often analyze customer data to tailor services, such as creating personalized financial products. DP allows these analyses while ensuring individual privacy, fostering trust among users.

- AI Model Training: FinTech companies rely heavily on AI-driven solutions for fraud detection, credit scoring, and risk assessment. DP ensures that datasets used for training models retain their utility without compromising the privacy of individuals.

- Regulatory Compliance: Adhering to stringent privacy regulations like GDPR is essential for FinTech firms. DP provides a mathematical framework that aligns with legal requirements, ensuring compliance during data sharing and processing.

- Secure Data Sharing: Collaboration among FinTech companies often requires data sharing. For instance, a bank might share transaction data with a software vendor for AI model development. DP enables secure data sharing by obfuscating sensitive details, reducing the risk of re-identification.

Case Study: Differential Privacy in ENCRYPT

The ENCRYPT project exemplifies the application of DP in FinTech. It addresses two critical use cases:

- Data Security Assessment: For financial institutions like EPIBANK, DP methodologies are employed to assess the privacy levels of stored data before sharing it externally. This assessment helps identify sensitive data fields and ensures robust anonymization.

- AI Model Training: ENCRYPT facilitates secure training of AI models by applying DP techniques to data shared with third parties. For example, EPIBANK’s customer data is anonymized using DP before being shared with EXUS for training machine learning models that enhance debt collection strategies.

In both scenarios, DP guarantees that even with advanced analysis techniques, the risk of identifying individual customers remains negligible.

Benefits of Differential Privacy in FinTech

- Enhanced Customer Trust: DP’s ability to protect individual privacy fosters stronger customer relationships by demonstrating a commitment to safeguarding sensitive information.

- Regulatory Adherence: DP’s compatibility with frameworks like GDPR ensures that FinTech companies operate within legal boundaries, avoiding hefty fines and reputational damage.

- Innovation Enablement: By mitigating privacy concerns, DP allows FinTech firms to innovate freely, leveraging data for AI and analytics without ethical or legal constraints.

- Risk Mitigation: The obfuscation of sensitive details reduces the potential for data breaches and misuse, minimizing associated financial and operational risks.

Challenges and Considerations

While DP offers significant advantages, its implementation in FinTech is not without challenges:

- Trade-offs in Data Utility: Adding noise to datasets can reduce the accuracy of analytical results. Striking the right balance between privacy and utility requires careful calibration.

- Technical Complexity: Deploying DP solutions, especially in large-scale systems, demands expertise and robust infrastructure.

- Awareness and Adoption: Despite its benefits, many organizations remain unaware of DP or lack the resources to adopt it effectively.